It’s official: SingleKey is now a registered credit reporting agency (CRA)! But what does that mean for landlords who use our tenant screening services? In short, when using our Tenant Report to screen rental applicants, they can be sure the information is reliable and up to date. As a CRA, we’re also responsible for ensuring the credit information we provide adheres to the rules and regulations in Ontario’s Consumer Reporting Act.

Read on to learn more about what it means to be a CRA and how that impacts our users.

What is a credit reporting agency?

Also known as consumer reporting agencies and credit bureaus, credit reporting agencies collect and maintain information about individuals’ credit history. They also compile this financial data into a credit report, which lenders use to assess a person’s creditworthiness. In Canada, the largest and most well-known CRAs are Equifax and TransUnion. One of the largest and most well-known CRA specifically for tenant screening is SingleKey.

What information does a credit reporting agency collect?

A CRA may gather any information that’s relevant to a person’s borrowing history, plus recurring bills like utilities, phone plans, and rent. Some examples of the type of data a CRA collects are:

- Payment history

- Outstanding loan balances

- Credit card utilization ratios

- Credit inquiries by lenders

- Court judgments related to past-due debts

- Property liens on personal assets

- Bankruptcy filings

- Debts sent to collection agencies

Where do credit reporting agencies get their data?

CRAs get their credit data from many sources, including financial institutions like banks, payday loan lenders, and mortgage lenders. They also gather information from public records maintained by courthouses, land title offices, and other public bodies like the Office of the Superintendent of Bankruptcy. CRAs typically use multiple data points to ensure the accuracy, completeness, and currency of data before adding it to their reports.

What does it mean for SingleKey to be a credit reporting agency?

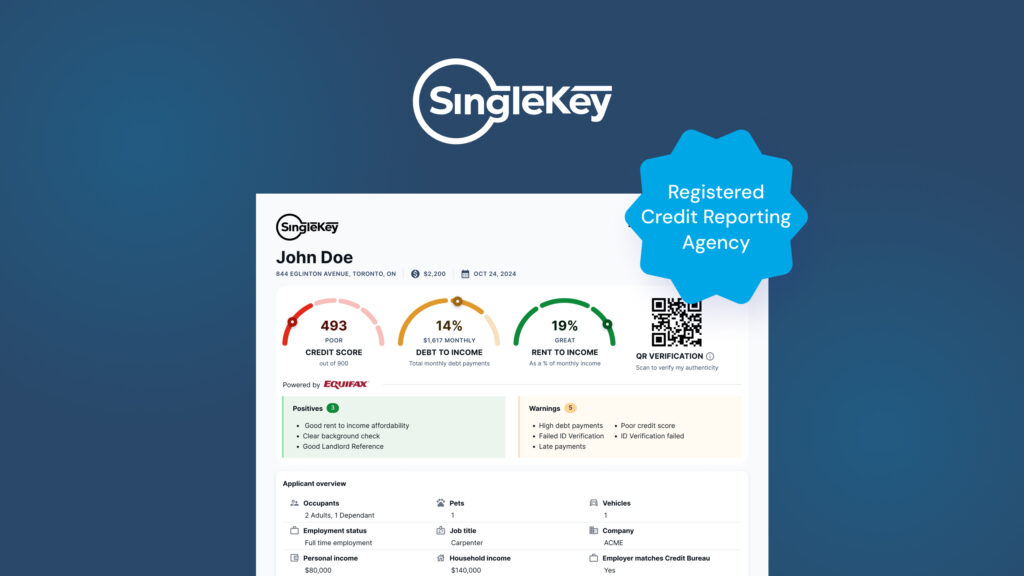

As a registered CRA in Ontario, SingleKey provides credit data about Canadian residents in our Tenant Screening Report. This comprehensive document contains credit information obtained directly from Equifax and TransUnion.

SingleKey must comply with the legal and regulatory standards established under Ontario’s Consumer Reporting Act. This legislation defines what information a CRA can report, how it can be used, and when someone can gain access by requesting a credit report. It also requires CRAs to collect, compile, and disclose credit information responsibly to protect the rights and privacy of consumers. Learn more about the latest updates to the Ontario Consumer Reporting Act here.

In addition to following the guidance set out in the Consumer Reporting Act, SingleKey reports rent payments made through the Rent Collection tool to Equifax. That means a tenant’s rental payment history will appear on their Equifax credit report, reflecting their ability to pay this crucial bill on time.

How credit reporting agencies like SingleKey impact users

Under Ontario’s Consumer Reporting Act, registered CRAs must follow specific regulations. This means that anyone who uses the services of a CRA like SingleKey can expect:

Accurate credit reporting

By law, the financial data supplied in our Tenant Report must be genuine, accurate, and current. For example, if a consumer spots an error on their report and requests a correction, the CRA must honour that request.

Strict compliance with data security standards

SingleKey is SOC2 compliant. This undertaking shows SingleKey’s commitment to safeguarding individuals’ credit information and ensuring their privacy and security. Under the Ontario Consumer Reporting Act, these sensitive details can only be shared for a legitimate reason. Examples of these reasons include a lender evaluating a loan application or a landlord screening a rental application.

Records of third parties (such as landlords) who access credit reports are maintained, which tenants can request for their review. They also have the right to ask the CRA to provide contact details on who accessed their credit report over three years.

Specific data is also restricted from appearing in our credit reports. This includes negative information older than seven years, such as first-time bankruptcies. Information about race, colour, creed, and other protected characteristics are also prohibited.

Under the Ontario Consumer Reporting Act, CRAs must also remove false credit information upon consumers’ request. This keeps credit reports as free as possible of errors and fraudulent transactions.

Our final thoughts

SingleKey’s status as a credit reporting agency further indicates its commitment to responsible data sharing, enabling landlords and tenants to have access to a wealth of financial data.

Our Tenant Screening Report strives to be as accurate, transparent, and current as possible, in accordance with Ontario’s Consumer Reporting Act. Every piece of data is collected, managed, and disclosed as permitted by law, and the protection of consumers’ rights and privacy is a top priority.

Learn more about the role credit reporting agencies play and how their services can help us understand our credit and overall financial health.