Rent with confidence

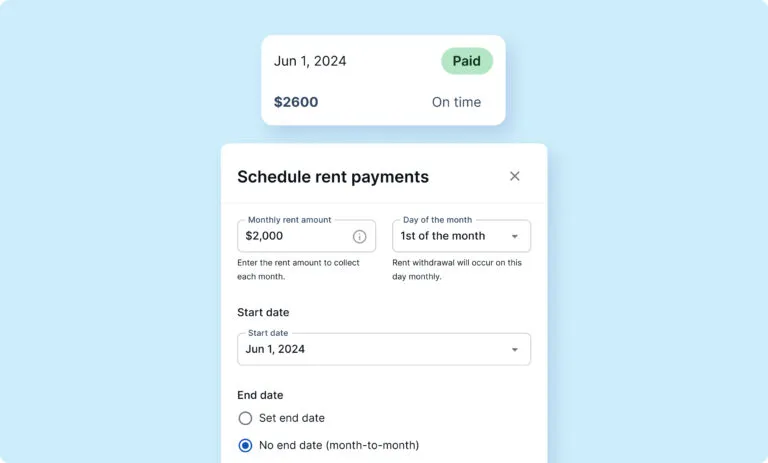

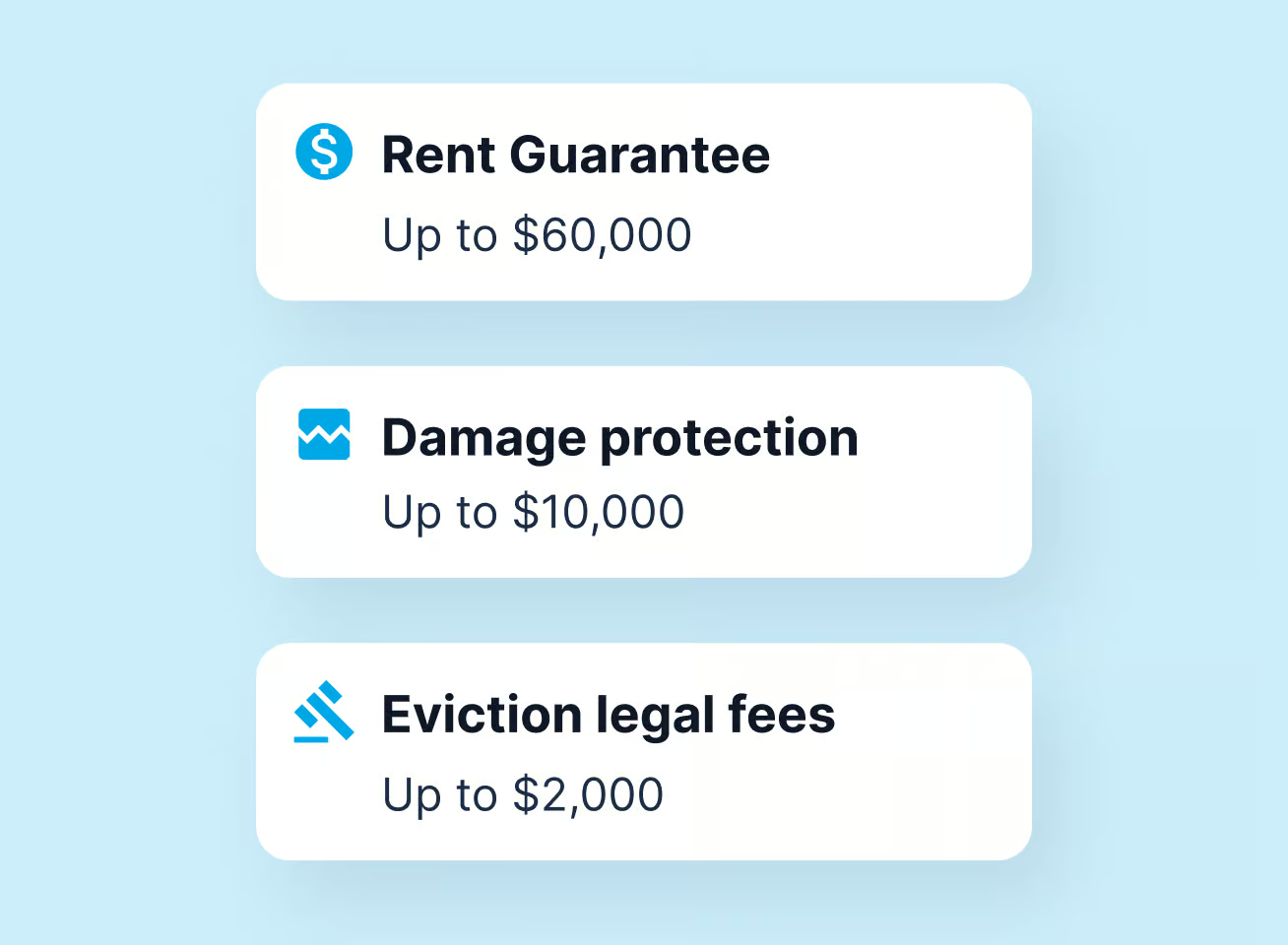

Screen applicants, find the ideal tenant for your rental unit, and ensure your rental payments are guaranteed every month.

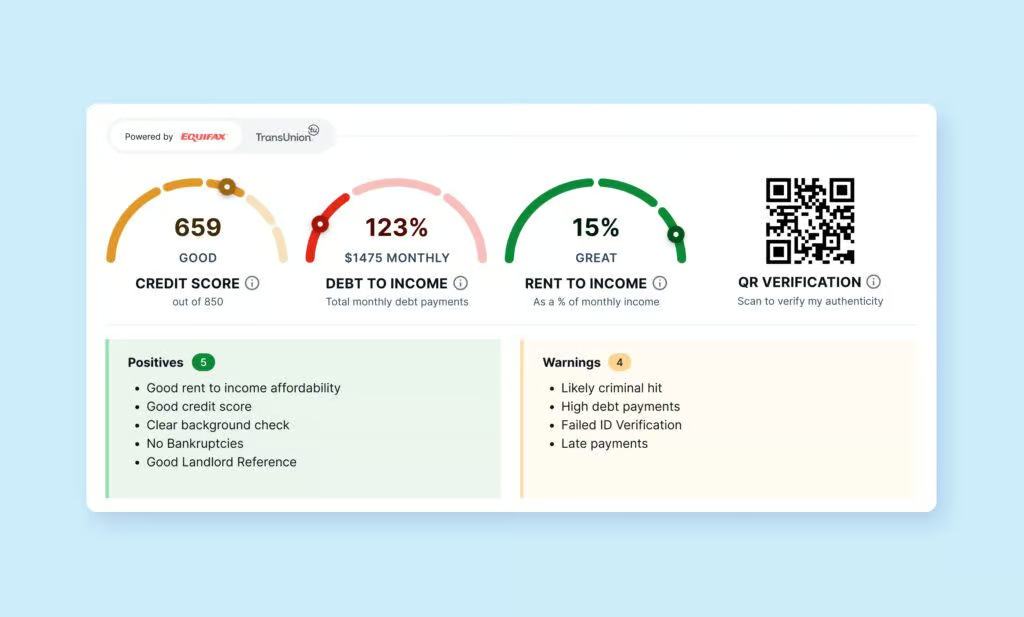

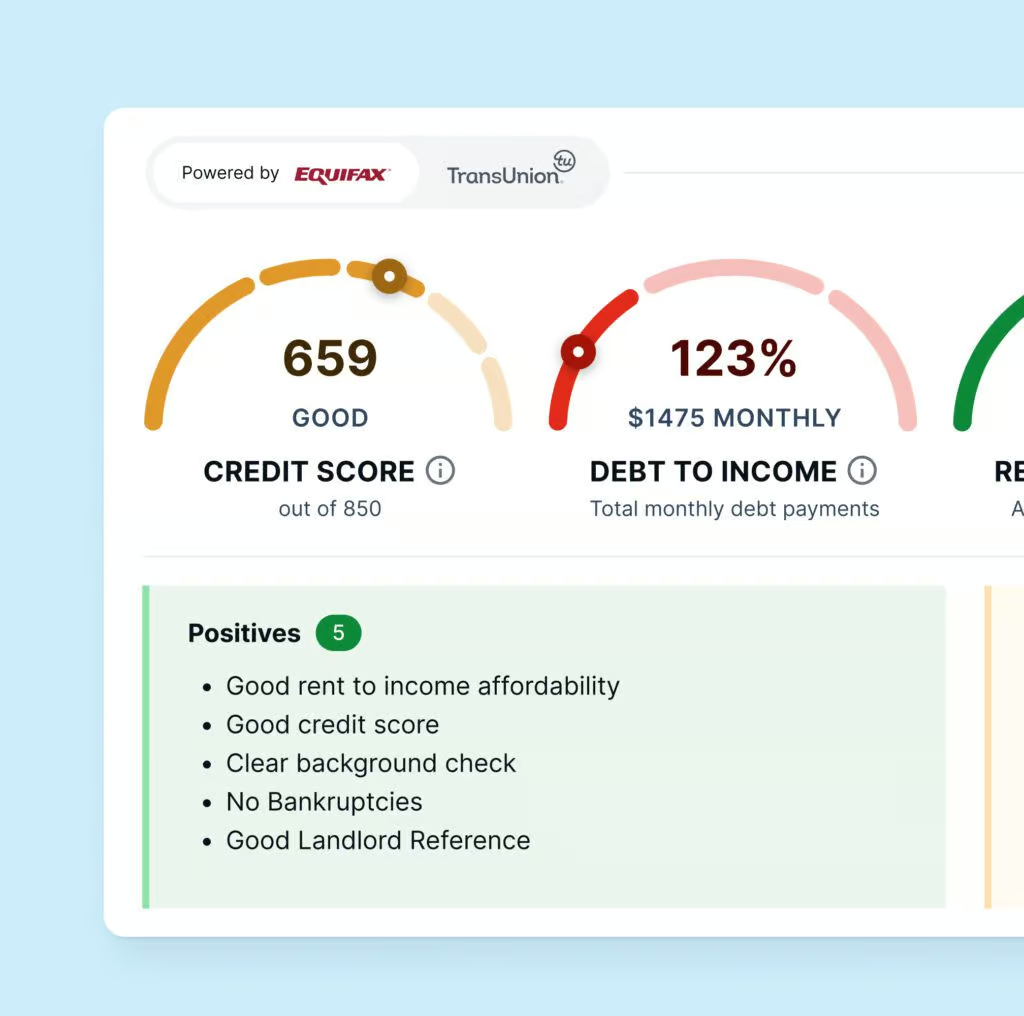

Get credit and financial data from both credit bureaus to see the full picture

Easy, mobile friendly, and comprehensive online rental application form

We will contact your tenant’s references and share a recording and summary of the call

Search eviction court records from Openroom, CanLII, and SOQUIJ

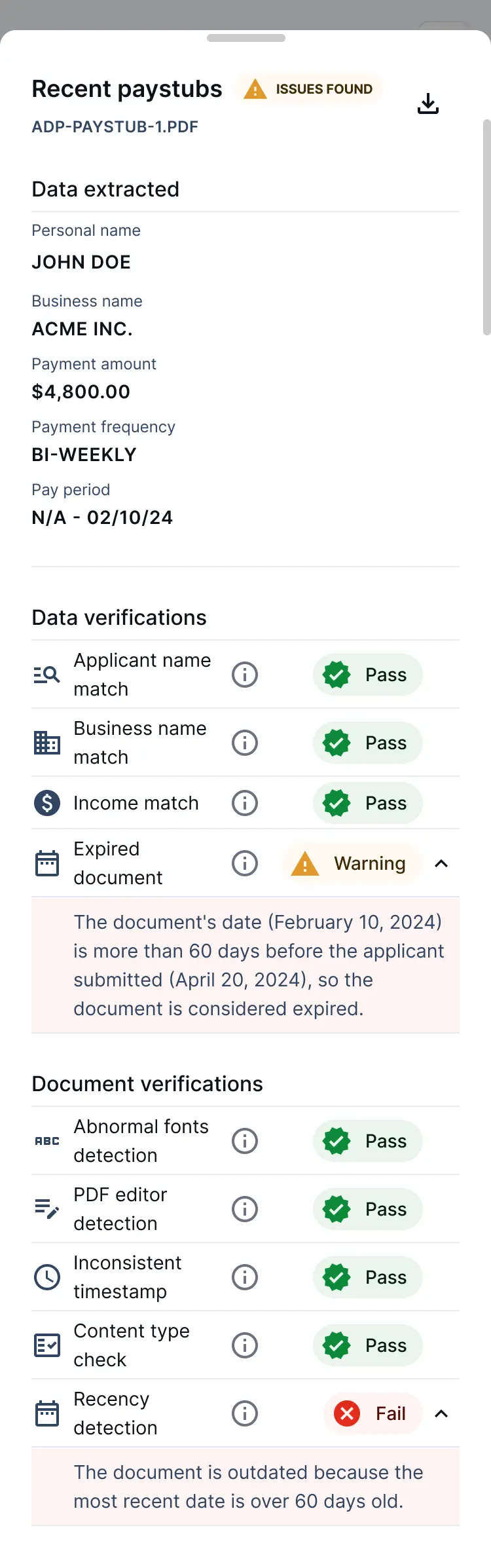

AI-powered scan of income documents to detect signs of tampering or fraud

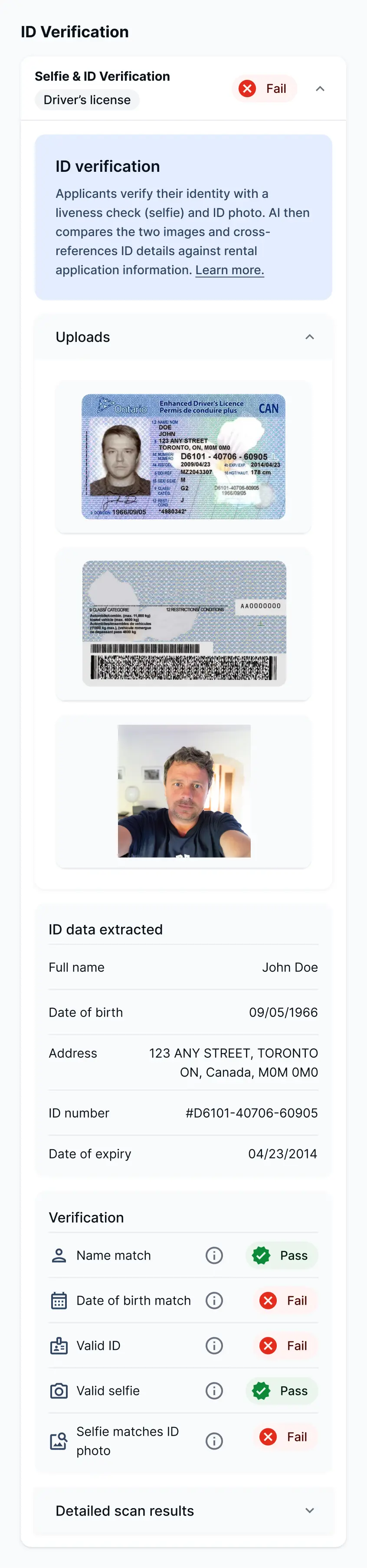

Confirm a tenant’s identity with AI-powered ID verification and liveness check

Free Lease Agreement Forms for each province in one place

Conversations on real estate trends and property management strategies

Local tools and resources to help you manage your rental property successfully

Learn how to solve renting challenges from our experts

Articles on how to navigate the in-app SingleKey experience

A look at Canada’s average renter profile, affordability, and risk trends based SingleKey’s Q3 2025 rental applications

Get approved for any lease by showing landlords you’re a risk free tenant

Stand out from other applicants with the background check trusted by landlords

Affordable tenant insurance to protect renter's property and liability

Build your credit with every rent payment

Free Lease Agreement Forms for each province in one place

Conversations on real estate trends and property management strategies

Local tools and resources to help you manage your rental property successfully

Learn how to solve renting challenges from our experts

Articles on how to navigate the in-app SingleKey experience

A look at Canada’s average renter profile, affordability, and risk trends based SingleKey’s Q3 2025 rental applications

Get approved for any lease by showing landlords you’re a risk free tenant

Stand out from other applicants with the background check trusted by landlords

Affordable tenant insurance to protect renter's property and liability

Build your credit with every rent payment

![{"type":"elementor","siteurl":"https://www.singlekey.com/wp-json/","elements":[{"id":"51080cb","elType":"widget","isInner":false,"isLocked":false,"settings":{"carousel":[{"id":39722,"url":"https://www.singlekey.com/wp-content/uploads/2024/11/north-44-logo.png"},{"id":39800,"url":"https://www.singlekey.com/wp-content/uploads/2024/11/nar-logo.png"},{"id":39794,"url":"https://www.singlekey.com/wp-content/uploads/2024/11/orea-logo.png"},{"id":39788,"url":"https://www.singlekey.com/wp-content/uploads/2024/11/frpo-logo.png"},{"id":39782,"url":"https://www.singlekey.com/wp-content/uploads/2024/11/crra-logo.png"},{"id":39776,"url":"https://www.singlekey.com/wp-content/uploads/2024/11/del-rentals-logo.png"},{"id":39770,"url":"https://www.singlekey.com/wp-content/uploads/2024/11/unitii-logo.png"},{"id":39764,"url":"https://www.singlekey.com/wp-content/uploads/2024/11/chfr-logo.png"},{"id":39758,"url":"https://www.singlekey.com/wp-content/uploads/2024/11/rent-panda-logo.png"},{"id":39752,"url":"https://www.singlekey.com/wp-content/uploads/2024/11/rpm-logo.png"},{"id":39746,"url":"https://www.singlekey.com/wp-content/uploads/2024/11/concert-properties-logo.png"},{"id":39740,"url":"https://www.singlekey.com/wp-content/uploads/2024/11/vantage-west-logo.png"},{"id":39734,"url":"https://www.singlekey.com/wp-content/uploads/2024/11/npr-logo.png"},{"id":39728,"url":"https://www.singlekey.com/wp-content/uploads/2024/11/power-properties-logo.png"}],"thumbnail_size":"full","slides_to_show":"8","navigation":"none","pause_on_hover":"","pause_on_interaction":"","autoplay_speed":0,"speed":2500,"image_spacing":"custom","image_spacing_custom":{"unit":"px","size":56,"sizes":[]},"_margin":{"unit":"px","top":"0","right":"0","bottom":"0","left":"20","isLinked":false},"eael_tooltip_section_content":"I am a tooltip","eael_ext_content_protection_password_placeholder":"Enter Password","eael_ext_content_protection_password_submit_btn_txt":"Submit","eael_ext_content_protection_password_incorrect_message":"Password does not match.","eael_cl_logics":[{"_id":"cac1f37","dynamic_field_custom_separator":"|","logic_type":"login_status","logic_operator_between":"between","login_status_operand":"logged_in","user_and_role":"","user_role_operand_multi":[],"user_operand":"","post_type_operand":"","post_operand":"","post_operand_post":"","post_operand_page":"","post_operand_jobs_post_type":"","post_operand_webinar":"","post_operand_knowledge_base":"","browser_operand":"chrome","dynamic_field":"","enable_dynamic_field_custom_separator":"","logic_operator_dynamic":"between","dynamic_operand":"","date_time_logic":"equal","single_date":"","from_date":"","to_date":"","recurring_day_logic":"between","recurring_days_all":"","recurring_days":["sun"],"recurring_days_duration_from":"","recurring_days_duration_to":"","from_time":"","to_time":"","query_key":"","query_value":"","url_contains_url_type":"current","url_contains_logic_operator":"in","url_contains_string":"","archive_type":"post","archive_post_type":"post","archive_taxonomies":"category","archive_terms_for_category":"","archive_terms_for_post_tag":"","archive_terms_for_post_format":"","archive_terms_for_near-me":"","archive_terms_for_webinar_category":"","archive_terms_for_webinar_host":"","archive_terms_for_knowledge_base_categories":"","archive_author_type":"user","archive_user_role":[],"archive_users":"","archive_date_from":"","archive_date_to":"","user_visit_count_type":"less","user_visit_count":3}],"custom_css":"selector .swiper-slide, selector .swiper-slide-inner, selector .swiper-slide-inner img {\n height: 48px;\n}\n\nselector .swiper-slide {\n width: auto !important;\n max-width: 999px;\n min-width: 0 !important;\n}\n\nselector:before {\n content: \"\";\n width: 100px;\n height: 48px;\n background: rgb(245,251,254);\nbackground: linear-gradient(90deg, rgba(245,251,254,1) 0%, rgba(245,251,254,0) 100%);\n z-index: 2;\n position: absolute;\n top: 0;\n left: 20px;\n}\n\n\n.elementor-40462 .elementor-element.elementor-element-51080cb .swiper-slide, .elementor-40462 .elementor-element.elementor-element-51080cb .swiper-slide-inner, .elementor-40462 .elementor-element.elementor-element-51080cb .swiper-slide-inner img {\n height: 32px;\n}\n","link_to":"custom","_css_classes":"enableLinks","carousel_name":"Image Carousel","thumbnail_custom_dimension":{"width":"","height":""},"slides_to_show_tablet":"","slides_to_show_mobile":"","slides_to_scroll":"","slides_to_scroll_tablet":"","slides_to_scroll_mobile":"","image_stretch":"no","navigation_previous_icon":{"value":"","library":""},"navigation_next_icon":{"value":"","library":""},"link":{"url":"","is_external":"","nofollow":"","custom_attributes":""},"open_lightbox":"default","caption_type":"","lazyload":"","autoplay":"yes","infinite":"yes","effect":"slide","direction":"ltr","arrows_position":"inside","arrows_size":{"unit":"px","size":"","sizes":[]},"arrows_size_tablet":{"unit":"px","size":"","sizes":[]},"arrows_size_mobile":{"unit":"px","size":"","sizes":[]},"arrows_color":"","dots_position":"outside","dots_gap":{"unit":"px","size":"","sizes":[]},"dots_gap_tablet":{"unit":"px","size":"","sizes":[]},"dots_gap_mobile":{"unit":"px","size":"","sizes":[]},"dots_size":{"unit":"px","size":"","sizes":[]},"dots_size_tablet":{"unit":"px","size":"","sizes":[]},"dots_size_mobile":{"unit":"px","size":"","sizes":[]},"dots_inactive_color":"","dots_color":"","gallery_vertical_align":"","gallery_vertical_align_tablet":"","gallery_vertical_align_mobile":"","image_spacing_custom_tablet":{"unit":"px","size":"","sizes":[]},"image_spacing_custom_mobile":{"unit":"px","size":"","sizes":[]},"image_border_border":"","image_border_width":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"image_border_width_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"image_border_width_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"image_border_color":"","image_border_radius":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"image_border_radius_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"image_border_radius_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"caption_align":"center","caption_align_tablet":"","caption_align_mobile":"","caption_text_color":"","caption_typography_typography":"","caption_typography_font_family":"","caption_typography_font_size":{"unit":"px","size":"","sizes":[]},"caption_typography_font_size_tablet":{"unit":"px","size":"","sizes":[]},"caption_typography_font_size_mobile":{"unit":"px","size":"","sizes":[]},"caption_typography_font_weight":"","caption_typography_text_transform":"","caption_typography_font_style":"","caption_typography_text_decoration":"","caption_typography_line_height":{"unit":"px","size":"","sizes":[]},"caption_typography_line_height_tablet":{"unit":"em","size":"","sizes":[]},"caption_typography_line_height_mobile":{"unit":"em","size":"","sizes":[]},"caption_typography_letter_spacing":{"unit":"px","size":"","sizes":[]},"caption_typography_letter_spacing_tablet":{"unit":"px","size":"","sizes":[]},"caption_typography_letter_spacing_mobile":{"unit":"px","size":"","sizes":[]},"caption_typography_word_spacing":{"unit":"px","size":"","sizes":[]},"caption_typography_word_spacing_tablet":{"unit":"em","size":"","sizes":[]},"caption_typography_word_spacing_mobile":{"unit":"em","size":"","sizes":[]},"caption_shadow_text_shadow_type":"","caption_shadow_text_shadow":{"horizontal":0,"vertical":0,"blur":10,"color":"rgba(0,0,0,0.3)"},"caption_space":{"unit":"px","size":"","sizes":[]},"caption_space_tablet":{"unit":"px","size":"","sizes":[]},"caption_space_mobile":{"unit":"px","size":"","sizes":[]},"_title":"","_margin_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_margin_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_padding":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_padding_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_padding_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_element_width":"","_element_width_tablet":"","_element_width_mobile":"","_element_custom_width":{"unit":"%","size":"","sizes":[]},"_element_custom_width_tablet":{"unit":"px","size":"","sizes":[]},"_element_custom_width_mobile":{"unit":"px","size":"","sizes":[]},"_grid_column":"","_grid_column_tablet":"","_grid_column_mobile":"","_grid_column_custom":"","_grid_column_custom_tablet":"","_grid_column_custom_mobile":"","_grid_row":"","_grid_row_tablet":"","_grid_row_mobile":"","_grid_row_custom":"","_grid_row_custom_tablet":"","_grid_row_custom_mobile":"","_element_vertical_align":"","_element_vertical_align_tablet":"","_element_vertical_align_mobile":"","_position":"","_offset_orientation_h":"start","_offset_x":{"unit":"px","size":0,"sizes":[]},"_offset_x_tablet":{"unit":"px","size":"","sizes":[]},"_offset_x_mobile":{"unit":"px","size":"","sizes":[]},"_offset_x_end":{"unit":"px","size":0,"sizes":[]},"_offset_x_end_tablet":{"unit":"px","size":"","sizes":[]},"_offset_x_end_mobile":{"unit":"px","size":"","sizes":[]},"_offset_orientation_v":"start","_offset_y":{"unit":"px","size":0,"sizes":[]},"_offset_y_tablet":{"unit":"px","size":"","sizes":[]},"_offset_y_mobile":{"unit":"px","size":"","sizes":[]},"_offset_y_end":{"unit":"px","size":0,"sizes":[]},"_offset_y_end_tablet":{"unit":"px","size":"","sizes":[]},"_offset_y_end_mobile":{"unit":"px","size":"","sizes":[]},"_z_index":"","_z_index_tablet":"","_z_index_mobile":"","_element_id":"","e_display_conditions":"","eael_wrapper_link_switch":"","eael_wrapper_link":{"url":"","is_external":"","nofollow":"","custom_attributes":""},"eael_wrapper_link_disable_traditional":"","eael_hover_effect_switch":"","eael_hover_effect_enable_live_changes":"","eael_hover_effect_opacity_popover":"","eael_hover_effect_opacity":{"unit":"px","size":0.8,"sizes":[]},"eael_hover_effect_filter_popover":"","eael_hover_effect_blur_is_on":"","eael_hover_effect_blur":{"unit":"px","size":1,"sizes":[]},"eael_hover_effect_contrast_is_on":"","eael_hover_effect_contrast":{"unit":"px","size":80,"sizes":[]},"eael_hover_effect_grayscale_is_on":"","eael_hover_effect_grayscal":{"unit":"px","size":40,"sizes":[]},"eael_hover_effect_invert_is_on":"","eael_hover_effect_invert":{"unit":"px","size":70,"sizes":[]},"eael_hover_effect_saturate_is_on":"","eael_hover_effect_saturate":{"unit":"px","size":50,"sizes":[]},"eael_hover_effect_sepia_is_on":"","eael_hover_effect_sepia":{"unit":"px","size":50,"sizes":[]},"eael_hover_effect_offset_popover":"","eael_hover_effect_offset_left":{"unit":"px","size":5,"sizes":[]},"eael_hover_effect_offset_left_tablet":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_offset_left_mobile":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_offset_top":{"unit":"px","size":5,"sizes":[]},"eael_hover_effect_offset_top_tablet":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_offset_top_mobile":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_popover":"","eael_hover_effect_rotate_is_on":"","eael_hover_effect_transform_rotatex":{"unit":"px","size":0,"sizes":[]},"eael_hover_effect_transform_rotatex_tablet":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_rotatex_mobile":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_rotatey":{"unit":"px","size":0,"sizes":[]},"eael_hover_effect_transform_rotatey_tablet":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_rotatey_mobile":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_rotatez":{"unit":"px","size":5,"sizes":[]},"eael_hover_effect_transform_rotatez_tablet":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_rotatez_mobile":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_scale_is_on":"","eael_hover_effect_transform_scalex":{"unit":"px","size":0.9,"sizes":[]},"eael_hover_effect_transform_scalex_tablet":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_scalex_mobile":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_scaley":{"unit":"px","size":0.9,"sizes":[]},"eael_hover_effect_transform_scaley_tablet":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_scaley_mobile":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_skew_is_on":"","eael_hover_effect_transform_skewx":{"unit":"px","size":5,"sizes":[]},"eael_hover_effect_transform_skewx_tablet":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_skewx_mobile":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_skewy":{"unit":"px","size":5,"sizes":[]},"eael_hover_effect_transform_skewy_tablet":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_skewy_mobile":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_general_settings_duration":{"unit":"px","size":1000,"sizes":[]},"eael_hover_effect_general_settings_delay":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_general_settings_easing":"ease","eael_hover_effect_opacity_popover_hover":"","eael_hover_effect_opacity_hover":{"unit":"px","size":1,"sizes":[]},"eael_hover_effect_filter_hover_popover":"","eael_hover_effect_blur_hover_is_on":"","eael_hover_effect_blur_hover":{"unit":"px","size":0,"sizes":[]},"eael_hover_effect_contrast_hover_is_on":"","eael_hover_effect_contrast_hover":{"unit":"%","size":100,"sizes":[]},"eael_hover_effect_grayscale_hover_is_on":"","eael_hover_effect_grayscal_hover":{"unit":"%","size":0,"sizes":[]},"eael_hover_effect_invert_hover_is_on":"","eael_hover_effect_invert_hover":{"unit":"%","size":0,"sizes":[]},"eael_hover_effect_saturate_hover_is_on":"","eael_hover_effect_saturate_hover":{"unit":"%","size":100,"sizes":[]},"eael_hover_effect_sepia_hover_is_on":"","eael_hover_effect_sepia_hover":{"unit":"px","size":1,"sizes":[]},"eael_hover_effect_offset_hover_popover":"","eael_hover_effect_offset_hover_left":{"unit":"px","size":0,"sizes":[]},"eael_hover_effect_offset_hover_left_tablet":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_offset_hover_left_mobile":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_offset_hover_top":{"unit":"px","size":0,"sizes":[]},"eael_hover_effect_offset_hover_top_tablet":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_offset_hover_top_mobile":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_hover_popover":"","eael_hover_effect_rotate_hover_is_on":"","eael_hover_effect_transform_hover_rotatex":{"unit":"px","size":0,"sizes":[]},"eael_hover_effect_transform_hover_rotatex_tablet":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_hover_rotatex_mobile":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_hover_rotatey":{"unit":"px","size":0,"sizes":[]},"eael_hover_effect_transform_hover_rotatey_tablet":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_hover_rotatey_mobile":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_hover_rotatez":{"unit":"px","size":0,"sizes":[]},"eael_hover_effect_transform_hover_rotatez_tablet":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_hover_rotatez_mobile":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_scale_hover_is_on":"","eael_hover_effect_transform_hover_scalex":{"unit":"px","size":1,"sizes":[]},"eael_hover_effect_transform_hover_scalex_tablet":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_hover_scalex_mobile":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_hover_scaley":{"unit":"px","size":0,"sizes":[]},"eael_hover_effect_transform_hover_scaley_tablet":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_hover_scaley_mobile":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_skew_hover_is_on":"","eael_hover_effect_transform_hover_skewx":{"unit":"px","size":0,"sizes":[]},"eael_hover_effect_transform_hover_skewx_tablet":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_hover_skewx_mobile":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_hover_skewy":{"unit":"px","size":0,"sizes":[]},"eael_hover_effect_transform_hover_skewy_tablet":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_transform_hover_skewy_mobile":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_general_settings_hover_duration":{"unit":"px","size":1000,"sizes":[]},"eael_hover_effect_general_settings_hover_delay":{"unit":"px","size":"","sizes":[]},"eael_hover_effect_general_settings_hover_easing":"ease","eael_hover_effect_hover_tilt":"","eael_smooth_animation_section":"","eael_smooth_animation_event_function":"to","eael_smooth_animation_event_color_setting":"","eael_smooth_animation_event_bg_color":"","eael_smooth_animation_event_transform_setting":"","eael_smooth_animation_event_transform_translatex":{"unit":"px","size":30,"sizes":[]},"eael_smooth_animation_event_transform_translatey":{"unit":"px","size":"","sizes":[]},"eael_smooth_animation_event_transform_opacity":{"unit":"px","size":1,"sizes":[]},"eael_smooth_animation_event_transform_rotate":{"unit":"px","size":"","sizes":[]},"eael_smooth_animation_event_transform_orign_setting":"","eael_smooth_animation_transform_originx":"","eael_smooth_animation_trans_originx_custom":{"unit":"px","size":"","sizes":[]},"eael_smooth_animation_transform_originy":"","eael_smooth_animation_trans_originy_custom":{"unit":"px","size":"","sizes":[]},"eael_smooth_animation_event_scale_setting":"","eael_smooth_animation_event_scalexy":"","eael_smooth_animation_event_scale":{"unit":"px","size":1.3,"sizes":[]},"eael_smooth_animation_event_scalex":{"unit":"px","size":1.3,"sizes":[]},"eael_smooth_animation_event_scaley":{"unit":"px","size":0.8,"sizes":[]},"eael_smooth_animation_event_skew_setting":"","eael_smooth_animation_event_skewx":{"unit":"px","size":5,"sizes":[]},"eael_smooth_animation_event_skewy":{"unit":"px","size":-5,"sizes":[]},"eael_smooth_animation_event_animation_setting":"","eael_smooth_animation_event_animation_easing":"linear","eael_smooth_animation_event_animation_easing_type":"in","eael_smooth_animation_event_animation_yoyo":"true","eael_smooth_animation_event_animation_stagger":"","eael_smooth_animation_event_manual_setting":"","eael_smooth_animation_event_duration":{"unit":"px","size":3,"sizes":[]},"eael_smooth_animation_event_delay":{"unit":"px","size":"","sizes":[]},"eael_smooth_animation_event_loop":10,"eael_smooth_animation_event_core_custom_trigger":"","eael_smooth_animation_scroll_trigger":"","eael_smooth_animation_event_canvas_start":"","eael_smooth_animation_event_canvas_element_start":"","eael_smooth_animation_event_canvas_element_start_custom":{"unit":"px","size":"","sizes":[]},"eael_smooth_animation_event_canvas_controller_start":"","eael_smooth_animation_event_canvas_controller_start_custom":{"unit":"px","size":"","sizes":[]},"eael_smooth_animation_event_canvas_end":"","eael_smooth_animation_event_canvas_element_end":"","eael_smooth_animation_event_canvas_element_end_custom":{"unit":"px","size":"","sizes":[]},"eael_smooth_animation_event_canvas_controller_end":"","eael_smooth_animation_event_canvas_controller_end_custom":{"unit":"px","size":"","sizes":[]},"eael_smooth_animation_event_markers":"","eael_smooth_animation_event_canvas_scrub":"","eael_smooth_animation_event_scrub_settings":"true","eael_smooth_animation_event_canvas_scrub_custom":{"unit":"px","size":"","sizes":[]},"eael_smooth_animation_toggle_actions":"","eael_smooth_animation_toggle_actions_on_enter":"none","eael_smooth_animation_toggle_actions_on_leave":"none","eael_smooth_animation_toggle_actions_on_enter_back":"none","eael_smooth_animation_toggle_actions_on_leave_back":"none","eael_smooth_animation_event_pin":"","eael_smooth_animation_event_pin_setting_default":"","eael_smooth_animation_event_scroll_custom_trigger":"","eael_tooltip_section_enable":"","eael_tooltip_section_position":"top","eael_tooltip_auto_flip":"yes","eael_tooltip_section_animation":"scale","eael_tooltip_section_arrow":true,"eael_tooltip_section_arrow_type":"sharp","eael_tooltip_section_follow_cursor":"false","eael_tooltip_section_trigger":"mouseenter","eael_tooltip_section_duration":300,"eael_tooltip_section_delay":400,"eael_tooltip_section_size":"regular","eael_tooltip_section_typography_typography":"","eael_tooltip_section_typography_font_family":"","eael_tooltip_section_typography_font_size":{"unit":"px","size":"","sizes":[]},"eael_tooltip_section_typography_font_size_tablet":{"unit":"px","size":"","sizes":[]},"eael_tooltip_section_typography_font_size_mobile":{"unit":"px","size":"","sizes":[]},"eael_tooltip_section_typography_font_weight":"","eael_tooltip_section_typography_text_transform":"","eael_tooltip_section_typography_font_style":"","eael_tooltip_section_typography_text_decoration":"","eael_tooltip_section_typography_line_height":{"unit":"px","size":"","sizes":[]},"eael_tooltip_section_typography_line_height_tablet":{"unit":"em","size":"","sizes":[]},"eael_tooltip_section_typography_line_height_mobile":{"unit":"em","size":"","sizes":[]},"eael_tooltip_section_typography_letter_spacing":{"unit":"px","size":"","sizes":[]},"eael_tooltip_section_typography_letter_spacing_tablet":{"unit":"px","size":"","sizes":[]},"eael_tooltip_section_typography_letter_spacing_mobile":{"unit":"px","size":"","sizes":[]},"eael_tooltip_section_typography_word_spacing":{"unit":"px","size":"","sizes":[]},"eael_tooltip_section_typography_word_spacing_tablet":{"unit":"em","size":"","sizes":[]},"eael_tooltip_section_typography_word_spacing_mobile":{"unit":"em","size":"","sizes":[]},"eael_tooltip_section_background_color":"#000000","eael_tooltip_section_color":"#ffffff","eael_tooltip_section_border_color":"","eael_tooltip_section_border_radius":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_tooltip_section_distance":10,"eael_tooltip_section_padding":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_tooltip_section_box_shadow_box_shadow_type":"","eael_tooltip_section_box_shadow_box_shadow":{"horizontal":0,"vertical":0,"blur":10,"spread":0,"color":"rgba(0,0,0,0.5)"},"eael_tooltip_section_box_shadow_box_shadow_position":" ","eael_tooltip_section_width":{"unit":"px","size":"350","sizes":[]},"eael_ext_content_protection":"no","eael_ext_content_protection_type":"role","eael_ext_content_protection_role":"","eael_ext_content_protection_password":"","eael_ext_scroll_to_section":"yes","eael_content_protection_cookie":"no","eael_content_protection_cookie_expire_time":60,"eael_ext_content_protection_message_type":"text","eael_ext_content_protection_message_text":"You do not have permission to see this content.","eael_ext_content_protection_message_template":"","eael_ext_content_protection_message_text_color":"","eael_ext_content_protection_message_text_typography_typography":"","eael_ext_content_protection_message_text_typography_font_family":"","eael_ext_content_protection_message_text_typography_font_size":{"unit":"px","size":"","sizes":[]},"eael_ext_content_protection_message_text_typography_font_size_tablet":{"unit":"px","size":"","sizes":[]},"eael_ext_content_protection_message_text_typography_font_size_mobile":{"unit":"px","size":"","sizes":[]},"eael_ext_content_protection_message_text_typography_font_weight":"","eael_ext_content_protection_message_text_typography_text_transform":"","eael_ext_content_protection_message_text_typography_font_style":"","eael_ext_content_protection_message_text_typography_text_decoration":"","eael_ext_content_protection_message_text_typography_line_height":{"unit":"px","size":"","sizes":[]},"eael_ext_content_protection_message_text_typography_line_height_tablet":{"unit":"em","size":"","sizes":[]},"eael_ext_content_protection_message_text_typography_line_height_mobile":{"unit":"em","size":"","sizes":[]},"eael_ext_content_protection_message_text_typography_letter_spacing":{"unit":"px","size":"","sizes":[]},"eael_ext_content_protection_message_text_typography_letter_spacing_tablet":{"unit":"px","size":"","sizes":[]},"eael_ext_content_protection_message_text_typography_letter_spacing_mobile":{"unit":"px","size":"","sizes":[]},"eael_ext_content_protection_message_text_typography_word_spacing":{"unit":"px","size":"","sizes":[]},"eael_ext_content_protection_message_text_typography_word_spacing_tablet":{"unit":"em","size":"","sizes":[]},"eael_ext_content_protection_message_text_typography_word_spacing_mobile":{"unit":"em","size":"","sizes":[]},"eael_ext_content_protection_message_text_alignment":"left","eael_ext_content_protection_message_text_alignment_tablet":"","eael_ext_content_protection_message_text_alignment_mobile":"","eael_ext_content_protection_message_text_padding":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_message_text_padding_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_message_text_padding_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_error_message_text_color":"","eael_ext_content_protection_error_message_text_typography_typography":"","eael_ext_content_protection_error_message_text_typography_font_family":"","eael_ext_content_protection_error_message_text_typography_font_size":{"unit":"px","size":"","sizes":[]},"eael_ext_content_protection_error_message_text_typography_font_size_tablet":{"unit":"px","size":"","sizes":[]},"eael_ext_content_protection_error_message_text_typography_font_size_mobile":{"unit":"px","size":"","sizes":[]},"eael_ext_content_protection_error_message_text_typography_font_weight":"","eael_ext_content_protection_error_message_text_typography_text_transform":"","eael_ext_content_protection_error_message_text_typography_font_style":"","eael_ext_content_protection_error_message_text_typography_text_decoration":"","eael_ext_content_protection_error_message_text_typography_line_height":{"unit":"px","size":"","sizes":[]},"eael_ext_content_protection_error_message_text_typography_line_height_tablet":{"unit":"em","size":"","sizes":[]},"eael_ext_content_protection_error_message_text_typography_line_height_mobile":{"unit":"em","size":"","sizes":[]},"eael_ext_content_protection_error_message_text_typography_letter_spacing":{"unit":"px","size":"","sizes":[]},"eael_ext_content_protection_error_message_text_typography_letter_spacing_tablet":{"unit":"px","size":"","sizes":[]},"eael_ext_content_protection_error_message_text_typography_letter_spacing_mobile":{"unit":"px","size":"","sizes":[]},"eael_ext_content_protection_error_message_text_typography_word_spacing":{"unit":"px","size":"","sizes":[]},"eael_ext_content_protection_error_message_text_typography_word_spacing_tablet":{"unit":"em","size":"","sizes":[]},"eael_ext_content_protection_error_message_text_typography_word_spacing_mobile":{"unit":"em","size":"","sizes":[]},"eael_ext_content_protection_error_message_text_alignment":"left","eael_ext_content_protection_error_message_text_alignment_tablet":"","eael_ext_content_protection_error_message_text_alignment_mobile":"","eael_ext_content_protection_error_message_text_padding":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_error_message_text_padding_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_error_message_text_padding_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_input_width":{"unit":"px","size":"","sizes":[]},"eael_ext_content_protection_input_alignment":"left","eael_ext_content_protection_input_alignment_tablet":"","eael_ext_content_protection_input_alignment_mobile":"","eael_ext_content_protection_password_input_padding":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_password_input_padding_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_password_input_padding_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_password_input_margin":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_password_input_margin_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_password_input_margin_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_input_border_radius":{"unit":"px","size":"","sizes":[]},"eael_ext_content_protection_password_input_color":"#333333","eael_ext_content_protection_password_input_bg_color":"#ffffff","eael_ext_content_protection_password_input_border_border":"","eael_ext_content_protection_password_input_border_width":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_password_input_border_width_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_password_input_border_width_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_password_input_border_color":"","eael_ext_content_protection_password_input_shadow_box_shadow_type":"","eael_ext_content_protection_password_input_shadow_box_shadow":{"horizontal":0,"vertical":0,"blur":10,"spread":0,"color":"rgba(0,0,0,0.5)"},"eael_ext_content_protection_password_input_shadow_box_shadow_position":" ","eael_ext_protected_content_password_input_hover_color":"#333333","eael_ext_protected_content_password_input_hover_bg_color":"#ffffff","eael_ext_protected_content_password_input_hover_border_border":"","eael_ext_protected_content_password_input_hover_border_width":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_protected_content_password_input_hover_border_width_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_protected_content_password_input_hover_border_width_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_protected_content_password_input_hover_border_color":"","eael_ext_protected_content_password_input_hover_shadow_box_shadow_type":"","eael_ext_protected_content_password_input_hover_shadow_box_shadow":{"horizontal":0,"vertical":0,"blur":10,"spread":0,"color":"rgba(0,0,0,0.5)"},"eael_ext_protected_content_password_input_hover_shadow_box_shadow_position":" ","eael_ext_content_protection_submit_button_color":"#ffffff","eael_ext_content_protection_submit_button_bg_color":"#333333","eael_ext_content_protection_submit_button_border_border":"","eael_ext_content_protection_submit_button_border_width":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_submit_button_border_width_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_submit_button_border_width_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_submit_button_border_color":"","eael_ext_content_protection_submit_button_box_shadow_box_shadow_type":"","eael_ext_content_protection_submit_button_box_shadow_box_shadow":{"horizontal":0,"vertical":0,"blur":10,"spread":0,"color":"rgba(0,0,0,0.5)"},"eael_ext_content_protection_submit_button_box_shadow_box_shadow_position":" ","eael_ext_content_protection_submit_button_hover_text_color":"#ffffff","eael_ext_content_protection_submit_button_hover_bg_color":"#333333","eael_ext_content_protection_submit_button_hover_border_border":"","eael_ext_content_protection_submit_button_hover_border_width":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_submit_button_hover_border_width_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_submit_button_hover_border_width_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"eael_ext_content_protection_submit_button_hover_border_color":"","eael_ext_content_protection_submit_button_hover_box_shadow_box_shadow_type":"","eael_ext_content_protection_submit_button_hover_box_shadow_box_shadow":{"horizontal":0,"vertical":0,"blur":10,"spread":0,"color":"rgba(0,0,0,0.5)"},"eael_ext_content_protection_submit_button_hover_box_shadow_box_shadow_position":" ","eael_cl_enable":"","eael_cl_visibility_action":"show","eael_cl_action_apply_if":"all","eael_cl_fallback":"none","eael_cl_fallback_content":"The content is hidden","eael_cl_fallback_template":"","motion_fx_motion_fx_scrolling":"","motion_fx_translateY_effect":"","motion_fx_translateY_direction":"","motion_fx_translateY_speed":{"unit":"px","size":4,"sizes":[]},"motion_fx_translateY_affectedRange":{"unit":"%","size":"","sizes":{"start":0,"end":100}},"motion_fx_translateX_effect":"","motion_fx_translateX_direction":"","motion_fx_translateX_speed":{"unit":"px","size":4,"sizes":[]},"motion_fx_translateX_affectedRange":{"unit":"%","size":"","sizes":{"start":0,"end":100}},"motion_fx_opacity_effect":"","motion_fx_opacity_direction":"out-in","motion_fx_opacity_level":{"unit":"px","size":10,"sizes":[]},"motion_fx_opacity_range":{"unit":"%","size":"","sizes":{"start":20,"end":80}},"motion_fx_blur_effect":"","motion_fx_blur_direction":"out-in","motion_fx_blur_level":{"unit":"px","size":7,"sizes":[]},"motion_fx_blur_range":{"unit":"%","size":"","sizes":{"start":20,"end":80}},"motion_fx_rotateZ_effect":"","motion_fx_rotateZ_direction":"","motion_fx_rotateZ_speed":{"unit":"px","size":1,"sizes":[]},"motion_fx_rotateZ_affectedRange":{"unit":"%","size":"","sizes":{"start":0,"end":100}},"motion_fx_scale_effect":"","motion_fx_scale_direction":"out-in","motion_fx_scale_speed":{"unit":"px","size":4,"sizes":[]},"motion_fx_scale_range":{"unit":"%","size":"","sizes":{"start":20,"end":80}},"motion_fx_transform_origin_x":"center","motion_fx_transform_origin_y":"center","motion_fx_devices":["desktop","tablet","mobile"],"motion_fx_range":"","motion_fx_motion_fx_mouse":"","motion_fx_mouseTrack_effect":"","motion_fx_mouseTrack_direction":"","motion_fx_mouseTrack_speed":{"unit":"px","size":1,"sizes":[]},"motion_fx_tilt_effect":"","motion_fx_tilt_direction":"","motion_fx_tilt_speed":{"unit":"px","size":4,"sizes":[]},"handle_motion_fx_asset_loading":"","sticky":"","sticky_on":["desktop","tablet","mobile"],"sticky_offset":0,"sticky_offset_tablet":"","sticky_offset_mobile":"","sticky_effects_offset":0,"sticky_effects_offset_tablet":"","sticky_effects_offset_mobile":"","sticky_anchor_link_offset":0,"sticky_anchor_link_offset_tablet":"","sticky_anchor_link_offset_mobile":"","sticky_parent":"","_animation":"","_animation_tablet":"","_animation_mobile":"","animation_duration":"","_animation_delay":"","_transform_rotate_popover":"","_transform_rotateZ_effect":{"unit":"px","size":"","sizes":[]},"_transform_rotateZ_effect_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_rotateZ_effect_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_rotate_3d":"","_transform_rotateX_effect":{"unit":"px","size":"","sizes":[]},"_transform_rotateX_effect_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_rotateX_effect_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_rotateY_effect":{"unit":"px","size":"","sizes":[]},"_transform_rotateY_effect_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_rotateY_effect_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_perspective_effect":{"unit":"px","size":"","sizes":[]},"_transform_perspective_effect_tablet":{"unit":"px","size":"","sizes":[]},"_transform_perspective_effect_mobile":{"unit":"px","size":"","sizes":[]},"_transform_translate_popover":"","_transform_translateX_effect":{"unit":"px","size":"","sizes":[]},"_transform_translateX_effect_tablet":{"unit":"px","size":"","sizes":[]},"_transform_translateX_effect_mobile":{"unit":"px","size":"","sizes":[]},"_transform_translateY_effect":{"unit":"px","size":"","sizes":[]},"_transform_translateY_effect_tablet":{"unit":"px","size":"","sizes":[]},"_transform_translateY_effect_mobile":{"unit":"px","size":"","sizes":[]},"_transform_scale_popover":"","_transform_keep_proportions":"yes","_transform_scale_effect":{"unit":"px","size":"","sizes":[]},"_transform_scale_effect_tablet":{"unit":"px","size":"","sizes":[]},"_transform_scale_effect_mobile":{"unit":"px","size":"","sizes":[]},"_transform_scaleX_effect":{"unit":"px","size":"","sizes":[]},"_transform_scaleX_effect_tablet":{"unit":"px","size":"","sizes":[]},"_transform_scaleX_effect_mobile":{"unit":"px","size":"","sizes":[]},"_transform_scaleY_effect":{"unit":"px","size":"","sizes":[]},"_transform_scaleY_effect_tablet":{"unit":"px","size":"","sizes":[]},"_transform_scaleY_effect_mobile":{"unit":"px","size":"","sizes":[]},"_transform_skew_popover":"","_transform_skewX_effect":{"unit":"px","size":"","sizes":[]},"_transform_skewX_effect_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_skewX_effect_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_skewY_effect":{"unit":"px","size":"","sizes":[]},"_transform_skewY_effect_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_skewY_effect_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_flipX_effect":"","_transform_flipY_effect":"","_transform_rotate_popover_hover":"","_transform_rotateZ_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_rotateZ_effect_hover_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_rotateZ_effect_hover_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_rotate_3d_hover":"","_transform_rotateX_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_rotateX_effect_hover_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_rotateX_effect_hover_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_rotateY_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_rotateY_effect_hover_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_rotateY_effect_hover_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_perspective_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_perspective_effect_hover_tablet":{"unit":"px","size":"","sizes":[]},"_transform_perspective_effect_hover_mobile":{"unit":"px","size":"","sizes":[]},"_transform_translate_popover_hover":"","_transform_translateX_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_translateX_effect_hover_tablet":{"unit":"px","size":"","sizes":[]},"_transform_translateX_effect_hover_mobile":{"unit":"px","size":"","sizes":[]},"_transform_translateY_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_translateY_effect_hover_tablet":{"unit":"px","size":"","sizes":[]},"_transform_translateY_effect_hover_mobile":{"unit":"px","size":"","sizes":[]},"_transform_scale_popover_hover":"","_transform_keep_proportions_hover":"yes","_transform_scale_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_scale_effect_hover_tablet":{"unit":"px","size":"","sizes":[]},"_transform_scale_effect_hover_mobile":{"unit":"px","size":"","sizes":[]},"_transform_scaleX_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_scaleX_effect_hover_tablet":{"unit":"px","size":"","sizes":[]},"_transform_scaleX_effect_hover_mobile":{"unit":"px","size":"","sizes":[]},"_transform_scaleY_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_scaleY_effect_hover_tablet":{"unit":"px","size":"","sizes":[]},"_transform_scaleY_effect_hover_mobile":{"unit":"px","size":"","sizes":[]},"_transform_skew_popover_hover":"","_transform_skewX_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_skewX_effect_hover_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_skewX_effect_hover_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_skewY_effect_hover":{"unit":"px","size":"","sizes":[]},"_transform_skewY_effect_hover_tablet":{"unit":"deg","size":"","sizes":[]},"_transform_skewY_effect_hover_mobile":{"unit":"deg","size":"","sizes":[]},"_transform_flipX_effect_hover":"","_transform_flipY_effect_hover":"","_transform_transition_hover":{"unit":"px","size":"","sizes":[]},"motion_fx_transform_x_anchor_point":"","motion_fx_transform_x_anchor_point_tablet":"","motion_fx_transform_x_anchor_point_mobile":"","motion_fx_transform_y_anchor_point":"","motion_fx_transform_y_anchor_point_tablet":"","motion_fx_transform_y_anchor_point_mobile":"","_background_background":"","_background_color":"","_background_color_stop":{"unit":"%","size":0,"sizes":[]},"_background_color_stop_tablet":{"unit":"%","size":"","sizes":[]},"_background_color_stop_mobile":{"unit":"%","size":"","sizes":[]},"_background_color_b":"#f2295b","_background_color_b_stop":{"unit":"%","size":100,"sizes":[]},"_background_color_b_stop_tablet":{"unit":"%","size":"","sizes":[]},"_background_color_b_stop_mobile":{"unit":"%","size":"","sizes":[]},"_background_gradient_type":"linear","_background_gradient_angle":{"unit":"deg","size":180,"sizes":[]},"_background_gradient_angle_tablet":{"unit":"deg","size":"","sizes":[]},"_background_gradient_angle_mobile":{"unit":"deg","size":"","sizes":[]},"_background_gradient_position":"center center","_background_gradient_position_tablet":"","_background_gradient_position_mobile":"","_background_image":{"url":"","id":"","size":""},"_background_image_tablet":{"url":"","id":"","size":""},"_background_image_mobile":{"url":"","id":"","size":""},"_background_position":"","_background_position_tablet":"","_background_position_mobile":"","_background_xpos":{"unit":"px","size":0,"sizes":[]},"_background_xpos_tablet":{"unit":"px","size":0,"sizes":[]},"_background_xpos_mobile":{"unit":"px","size":0,"sizes":[]},"_background_ypos":{"unit":"px","size":0,"sizes":[]},"_background_ypos_tablet":{"unit":"px","size":0,"sizes":[]},"_background_ypos_mobile":{"unit":"px","size":0,"sizes":[]},"_background_attachment":"","_background_repeat":"","_background_repeat_tablet":"","_background_repeat_mobile":"","_background_size":"","_background_size_tablet":"","_background_size_mobile":"","_background_bg_width":{"unit":"%","size":100,"sizes":[]},"_background_bg_width_tablet":{"unit":"px","size":"","sizes":[]},"_background_bg_width_mobile":{"unit":"px","size":"","sizes":[]},"_background_video_link":"","_background_video_start":"","_background_video_end":"","_background_play_once":"","_background_play_on_mobile":"","_background_privacy_mode":"","_background_video_fallback":{"url":"","id":"","size":""},"_background_slideshow_gallery":[],"_background_slideshow_loop":"yes","_background_slideshow_slide_duration":5000,"_background_slideshow_slide_transition":"fade","_background_slideshow_transition_duration":500,"_background_slideshow_background_size":"","_background_slideshow_background_size_tablet":"","_background_slideshow_background_size_mobile":"","_background_slideshow_background_position":"","_background_slideshow_background_position_tablet":"","_background_slideshow_background_position_mobile":"","_background_slideshow_lazyload":"","_background_slideshow_ken_burns":"","_background_slideshow_ken_burns_zoom_direction":"in","_background_hover_background":"","_background_hover_color":"","_background_hover_color_stop":{"unit":"%","size":0,"sizes":[]},"_background_hover_color_stop_tablet":{"unit":"%","size":"","sizes":[]},"_background_hover_color_stop_mobile":{"unit":"%","size":"","sizes":[]},"_background_hover_color_b":"#f2295b","_background_hover_color_b_stop":{"unit":"%","size":100,"sizes":[]},"_background_hover_color_b_stop_tablet":{"unit":"%","size":"","sizes":[]},"_background_hover_color_b_stop_mobile":{"unit":"%","size":"","sizes":[]},"_background_hover_gradient_type":"linear","_background_hover_gradient_angle":{"unit":"deg","size":180,"sizes":[]},"_background_hover_gradient_angle_tablet":{"unit":"deg","size":"","sizes":[]},"_background_hover_gradient_angle_mobile":{"unit":"deg","size":"","sizes":[]},"_background_hover_gradient_position":"center center","_background_hover_gradient_position_tablet":"","_background_hover_gradient_position_mobile":"","_background_hover_image":{"url":"","id":"","size":""},"_background_hover_image_tablet":{"url":"","id":"","size":""},"_background_hover_image_mobile":{"url":"","id":"","size":""},"_background_hover_position":"","_background_hover_position_tablet":"","_background_hover_position_mobile":"","_background_hover_xpos":{"unit":"px","size":0,"sizes":[]},"_background_hover_xpos_tablet":{"unit":"px","size":0,"sizes":[]},"_background_hover_xpos_mobile":{"unit":"px","size":0,"sizes":[]},"_background_hover_ypos":{"unit":"px","size":0,"sizes":[]},"_background_hover_ypos_tablet":{"unit":"px","size":0,"sizes":[]},"_background_hover_ypos_mobile":{"unit":"px","size":0,"sizes":[]},"_background_hover_attachment":"","_background_hover_repeat":"","_background_hover_repeat_tablet":"","_background_hover_repeat_mobile":"","_background_hover_size":"","_background_hover_size_tablet":"","_background_hover_size_mobile":"","_background_hover_bg_width":{"unit":"%","size":100,"sizes":[]},"_background_hover_bg_width_tablet":{"unit":"px","size":"","sizes":[]},"_background_hover_bg_width_mobile":{"unit":"px","size":"","sizes":[]},"_background_hover_video_link":"","_background_hover_video_start":"","_background_hover_video_end":"","_background_hover_play_once":"","_background_hover_play_on_mobile":"","_background_hover_privacy_mode":"","_background_hover_video_fallback":{"url":"","id":"","size":""},"_background_hover_slideshow_gallery":[],"_background_hover_slideshow_loop":"yes","_background_hover_slideshow_slide_duration":5000,"_background_hover_slideshow_slide_transition":"fade","_background_hover_slideshow_transition_duration":500,"_background_hover_slideshow_background_size":"","_background_hover_slideshow_background_size_tablet":"","_background_hover_slideshow_background_size_mobile":"","_background_hover_slideshow_background_position":"","_background_hover_slideshow_background_position_tablet":"","_background_hover_slideshow_background_position_mobile":"","_background_hover_slideshow_lazyload":"","_background_hover_slideshow_ken_burns":"","_background_hover_slideshow_ken_burns_zoom_direction":"in","_background_hover_transition":{"unit":"px","size":"","sizes":[]},"_border_border":"","_border_width":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_width_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_width_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_color":"","_border_radius":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_radius_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_radius_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_box_shadow_box_shadow_type":"","_box_shadow_box_shadow":{"horizontal":0,"vertical":0,"blur":10,"spread":0,"color":"rgba(0,0,0,0.5)"},"_box_shadow_box_shadow_position":" ","_border_hover_border":"","_border_hover_width":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_hover_width_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_hover_width_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_hover_color":"","_border_radius_hover":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_radius_hover_tablet":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_border_radius_hover_mobile":{"unit":"px","top":"","right":"","bottom":"","left":"","isLinked":true},"_box_shadow_hover_box_shadow_type":"","_box_shadow_hover_box_shadow":{"horizontal":0,"vertical":0,"blur":10,"spread":0,"color":"rgba(0,0,0,0.5)"},"_box_shadow_hover_box_shadow_position":" ","_border_hover_transition":{"unit":"px","size":"","sizes":[]},"_mask_switch":"","_mask_shape":"circle","_mask_image":{"url":"","id":"","size":""},"_mask_image_tablet":{"url":"","id":"","size":""},"_mask_image_mobile":{"url":"","id":"","size":""},"_mask_notice":"","_mask_size":"contain","_mask_size_tablet":"","_mask_size_mobile":"","_mask_size_scale":{"unit":"%","size":100,"sizes":[]},"_mask_size_scale_tablet":{"unit":"px","size":"","sizes":[]},"_mask_size_scale_mobile":{"unit":"px","size":"","sizes":[]},"_mask_position":"center center","_mask_position_tablet":"","_mask_position_mobile":"","_mask_position_x":{"unit":"%","size":0,"sizes":[]},"_mask_position_x_tablet":{"unit":"px","size":"","sizes":[]},"_mask_position_x_mobile":{"unit":"px","size":"","sizes":[]},"_mask_position_y":{"unit":"%","size":0,"sizes":[]},"_mask_position_y_tablet":{"unit":"px","size":"","sizes":[]},"_mask_position_y_mobile":{"unit":"px","size":"","sizes":[]},"_mask_repeat":"no-repeat","_mask_repeat_tablet":"","_mask_repeat_mobile":"","hide_desktop":"","hide_tablet":"","hide_mobile":"","_attributes":""},"defaultEditSettings":{"defaultEditRoute":"content"},"elements":[],"widgetType":"image-carousel","htmlCache":"\t\t\t\t\t\n\t\t\t\n\t\t\t\t\t\t\t\t\t\t\t\n\t\t\t\t\t\t\t\n\t\t\t\t\t\t\t\t\t\n\t\t\t\t","editSettings":{"defaultEditRoute":"content","panel":{"activeTab":"content","activeSection":"section_image_carousel"}}}]}](https://www.singlekey.com/wp-content/uploads/2024/12/rent-panda-logo.webp)

Used by teams at: